私の心情(193)―資産活用アドバイス75―海外におけるDecumulation議論

Decumulationを巡る、香港、米国の状況

2023年6月に韓国ソウルで開催されたInternational Council of Securities Association (ICSA)の第36回年次総会のInternational Conferenceに参加してきました。その中のLifetime Income & Retirement Redefinedをテーマとしたパネルディスカッションでは、パネラーとして参加し、香港、米国、韓国の専門家とRetirement Incomeに関して議論し、また3日間の滞在中に情報シェアもしました。

私のプレゼンはこれまでも国内のセミナーなどでお話している内容を伝えたものであまり代わり映えしませんが、この資料の後半に加えています。それよりも、香港のMPF、米国のDC/IRAでのDecumulationを巡る議論は大変興味深いもので、私が日本で議論しているのと同じく「Decumulationは商品ではなく、サービスを提供すること」だという点で一致していたことは、改めて自説に対する自信を深めることになりました。そのポイントを簡単にまとめておきます。

香港のMPF(Mandatory Provident Fund)でも一括引出が大半

-By Alice Law、元Mandatory Provident Fund Scheme Authorityの副会長で、現在はAsia Securities Industry & Financial Market Association(ASIFMA)の会長

25年前にスタートした香港の強制加入の確定拠出年金制度(MPF)は、現在運用資産額が1兆香港ドルを超え、勤労者の7割以上にあたる300万人以上が加入している。

過去20年にわたって改良を加えてきた中で、Decumulationに関しても、“Stay invested”を念頭に商品やコンセプトを提供している。MPFのなかでは定期的な引き出しのシステムを提供している他、MPFの外側では政府が提供しているPublic Annuityも提供されている。例えば、65歳男性で100万香港ドルの資産の場合、月額5,800香港ドルを受け取ることができ、182か月間の保証を加えて終身で年金が給付される。とはいえ、現状は大半が一括引出を選好している点が大きな課題だ。

米国DC/IRA、「引き出しは純粋な商品の問題ではない」との認識が広がる

-By Peter Stewart、Mercerのシニア・プリンシパルでGlobal Wealth Consultant

米国のRetirement の市場規模はDCとIRAを合わせて23.6兆ドル。IRAはそのほとんどがDCからの移管で占められており、DCでAccumulateして、IRAでDecumulateするスタイルに。そのためDCのプランスポンサーはDCのシステム内でDecumulationが行われるように仕向けたいと動いている。

これまでもそれを実現するために商品開発は行われてきたが、うまくいっていない。変額年金(VA)はそれほど注目されず、マネジメント・アカウントなどには少しずつ注目が集まり始めている。退職後の資金の引き出しはコミュニケーションやエンゲージメントが重視され、純粋な商品の問題ではなくなっている―最近Retirement tierという言葉が使われ、退職世代に必要な包括的なソリューションを提供することが重視されている。

2019年に成立したSECURE法のRetirement Income条項で、Retirement Income(退職後の資産収入)の予測を提供することが求められ、またRetirement income annuity導入に関するセーフハーバールールが盛り込まれたことが、Retirement tierの機運を高めている。

Retirement Incomeを提供するためのソリューションとして、保証型では、①従来型のアニュイティ(終身年金)、②アニュイティを組み込んだターゲット・デート・ファンド、非保証型では、③分配金を重視したファンド、④支払い機能を付けたマネージド・アカウント、⑤払い出し機能を付けたターゲット・デート・ファンドといったものがある

(参考)私のプレゼン骨子

拙い英語のままですが、参考になればと思い、プレゼン資料とスクリプトを以下に収載します。

Decumulation Services in Super-aged Society

I will cover four main points in my Short Presentation today.

Firstly, I will explain the concept of “Decumulation” in contrast to “Accumulation.“

Secondly, I will highlight how the super-aged society will significantly impact the financial industry.

Thirdly, I will discuss financial products and services related to decumulation.

And lastly, I will provide an overview of the new NISA starting in 2024, its significance, and address decumulation-related issues.

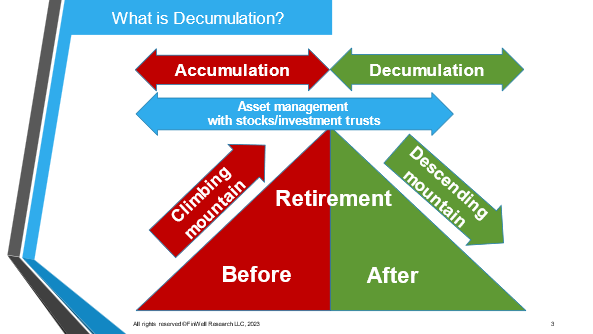

Accu/Decu vs. Mountaineering

Please refer to the first diagram, which compares the way people deal with money throughout their lives to mountaineering.

The red area represents accumulation phase, akin to climbing mountain.

The height of the mountain represents the size of the assets accumulated, with the summit representing retirement age.

The green part is the descent from the top of the mountain, known as decumulation, where assets are gradually withdrawn to cover retirement expenses.

It is crucial to manage assets during this phase, envisioning a strategy of “withdrawing while investing” situation.

During decumulation, 2 key points should be emphasized. Firstly, it is important to find the slowest possible route down the mountain and to get as far as possible, which means extending the life of your assets as much as possible.

Secondly, as mountaineers know, you should never start climbing a mountain without checking the descent route.

Normally, we should plan decumulation, then start accumulation, but this is often not the case.

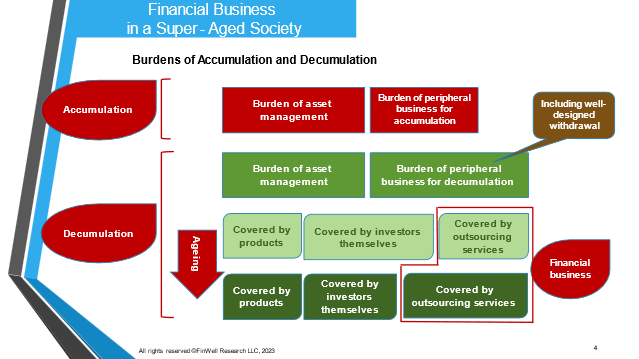

Burden levels of Accu/Decu

The diagram on the next page compares the burden levels for clients in the Accumulation and Decumulation phases.

The top row shows the burden for accumulators, divided into 2 parts, the asset management portion and the peripheral operations portion. Peripheral work includes planning how much money to invest, what stocks to buy, and when to buy them. However, once you start a monthly savings plan, these peripheral tasks are not so burdensome.

In decumulation, however, assets are managed and withdrawn little by little, so there are more complex variables, such as mitigating “sequence of returns risk,” determining the order of assets withdrawal, and understanding the taxation environment for retirement income. These are factors will increase the burden on peripheral operations.

Moreover, as clients age, the portion that they can do themselves will decrease. Naturally, this will result in outsourcing, and financial institutions will provide the necessary support. In other words, more than ever before financial businesses will be required to provide services rather than products and will have no choice but to respond to this demand.

In Japan, we have recently had a lot of discussion about IFAs, Independent Financial Advisors. The argument is that Japan should develop independent advisors, like in the UK. The key point, however, is that the current financial business in Japan still sticks to revenue from products. As this diagram shows, if demand for services grows, the current business model depending on revenues tied to products will one day become unprofitable.

I believe that the financial business in a super-aged society will have no choice but to change from fees tied to financial products to fees tied to services.

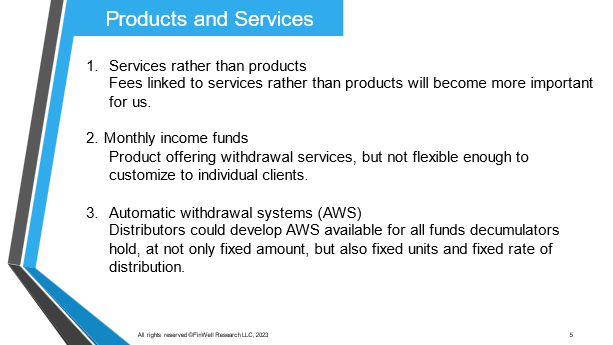

Services rather than products

In this context, I think the first point on the next page is easy to understand: decumulation should focus on how to provide financial services rather than financial products.

However, I think that service-added financial products will also attract attention as an intermediate category. A typical example are Annuity and the Monthly-income investment trust.

Annuity is not popular in Japan, because it can’t be created under zero-yields and elderly could hesitate to buy it because of behavioral bias that they prefer assets to contracts.

Monthly-income investment trusts emerged in the early 2000s in Japan. The trend was for the elderly to use distributions to supplement their public pension benefits, and for a time, most of the inflows into investment trusts went into monthly-income types.

However, the popularity of these products quickly disappeared after the FSA issued a warning against the excesses of this type of fund, as investors thought of the distributions as interest on their deposits and paid no attention to the fact that the principal was being reduced.

Moreover, it would cause real problems if the popularity of the product expanded to the accumulation segment and reduced the efficiency of investment through the payout of principal.

We still face challenges in how to use monthly-income investment trusts. I believe they are theoretically suited to decumulation, but unfortunately, it is not flexible enough to customize the level of payout to each customer’s demands.

In this regard, developing a distribution system would be very meaningful. In the US, brokerage firms have developed their own system called the automatic withdrawal system, and I believe there is room for Japan to take advantage of this.

Especially it is important for decumulation to withdraw at pre-fixed rate of distribution system and advisor could use it for their advice to avoid Sequence of returns risk.

New NISA, good for accumulators but not so for decumulators

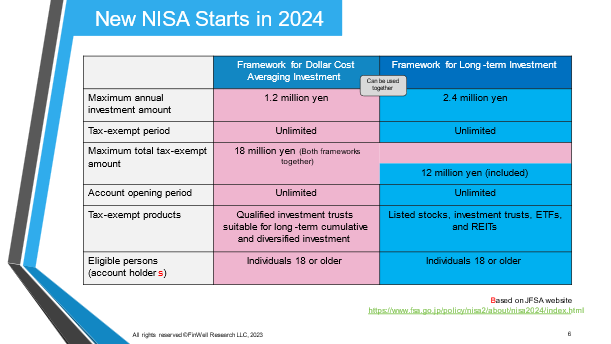

On last point, NISA was launched in Japan in 2014 based on the UK’s ISA system and will be greatly enhanced in 2024. Last year, Prime Minister Kishida’s “Asset Income Doubling Plan” included the expansion of NISA and is now being swiftly implemented.

This table shows details, but the key points are that tax-exempt period and account opening period are to become permanent. It must help accumulators enjoying long-term investment.

Through this enhancement, the government plans to boost the number of NISA accounts to 34 million in 5 years, up from the current 17 million.

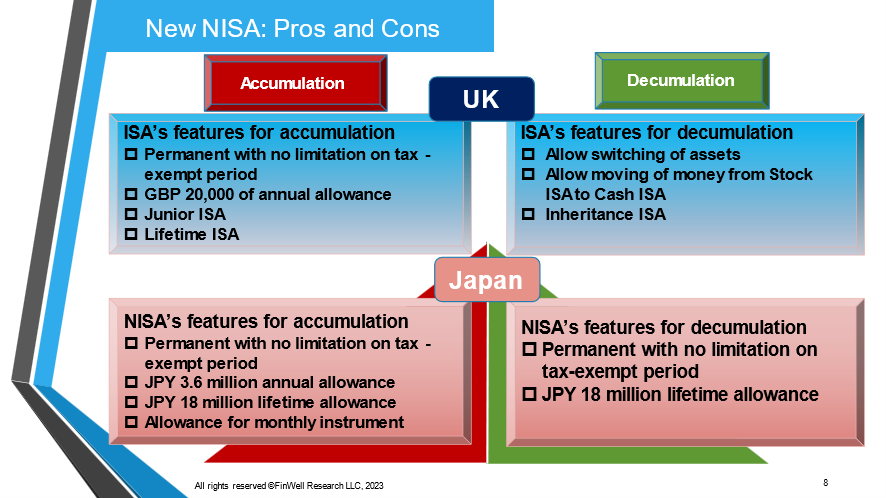

However, there are some challenges in the new NISA. This diagram shows us 2 types of comparison, between Japan and UK and between Accumulation and Decumulation. In accumulation side, NISA ‘s features will be as almost same as UK’s Stock ISA which contains of about 5% of national household assets. I expect new NISA will be a strong game changer for next few years in Japan.

But in Decumulation side, considering that the UK’s ISA system has been enhanced over the past decade to accommodate the aging of account holders by allowing moving money from Stock ISA to Cash ISA and launching Inheritance ISA, it seems that NISA will need to be further enhanced in the near future. I believe we need allowing switching of assets and removing lifetime allowance.

Thank you for your attention.